Life throws curveballs, and sometimes those curveballs come in the form of unexpected debt that can seriously damage your credit score. It’s a tough spot to be in, especially when you’re starting your career and trying to build a solid financial future. I know this feeling, and it reminds me of how we approach challenges in emerging markets – with resilience and a focus on practical problem-solving.

Imagine this: You’re a young professional, diligently managing your finances, and then bam! An old debt resurfaces, or an unexpected claim hits your credit report. Suddenly, your score, a number that quietly influences everything from renting an apartment to getting a good interest rate on a car loan, has taken a hit. It’s frustrating, but not insurmountable.

Let’s break down how to tackle this, drawing inspiration from building financial resilience, much like how businesses in developing economies adapt to dynamic environments.

1. Understand the Damage: Get Your Credit Report

The first step is always to know exactly where you stand. You’re entitled to a free credit report from the major credit bureaus annually. Pull yours and scrutinize every line. Is the debt accurate? Was it reported correctly? Identifying errors is crucial. Sometimes, a simple dispute can fix a problem.

2. Address the Debt Head-On

Once you’ve verified the debt, you need a plan. Ignoring it won’t make it disappear; it will only worsen.

- Negotiate: If the debt is valid, contact the creditor or collection agency. Many are willing to negotiate a settlement for less than the full amount, especially if you can pay it off quickly. Having funds ready to pay even a portion can give you leverage.

- Payment Plan: If a lump sum isn’t possible, propose a manageable payment plan. Document everything – agreed-upon amounts, dates, and the payment schedule.

3. Rebuilding Your Credit Score

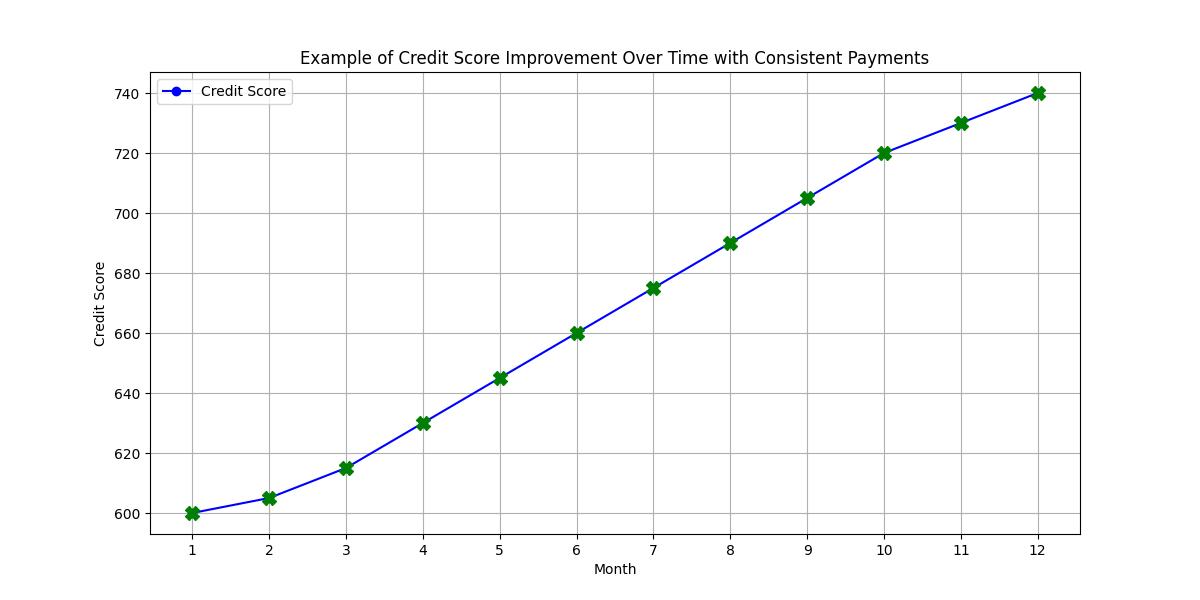

This is where the real work begins, and it requires patience and consistent effort.

- Secured Credit Card: A secured credit card requires a cash deposit, which usually becomes your credit limit. Use it for small, regular purchases and pay the balance in full every month. This is a straightforward way to demonstrate responsible credit behavior.

- Credit-Builder Loan: Some credit unions and banks offer these. You make payments on the loan, but the money is held by the bank until the loan is repaid. It’s a way to build a positive payment history.

- Become an Authorized User: If you have a trusted friend or family member with excellent credit, they might add you as an authorized user to their account. Their positive payment history can then reflect on your report. However, ensure they manage their account responsibly, as their mistakes can also impact you.

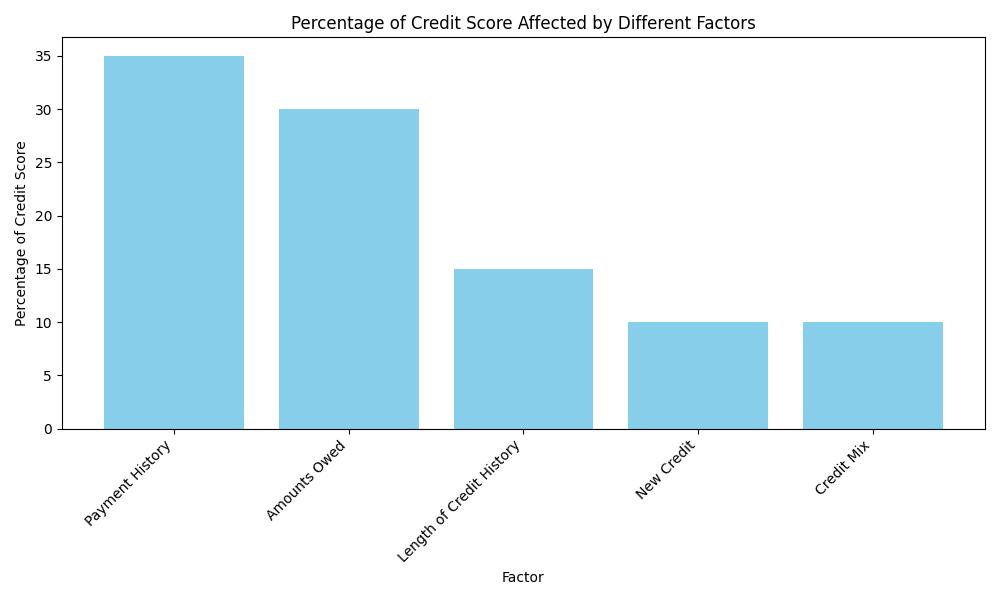

- Pay On Time, Every Time: This is non-negotiable. Payment history is the most significant factor in your credit score. Set up automatic payments or reminders.

4. Long-Term Financial Resilience

Think about this process as strengthening your financial foundation, much like diversifying investments to withstand market volatility. It’s about building habits that protect you from future shocks.

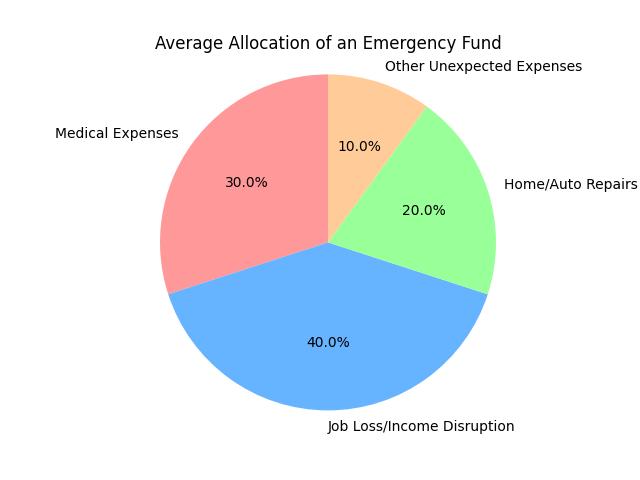

- Emergency Fund: Aim to save 3-6 months of living expenses. This fund is your safety net, preventing you from needing to rely on credit when unexpected expenses arise.

- Budgeting: Understand where your money is going. A clear budget helps you identify savings opportunities and ensures you’re living within your means.

Navigating credit damage after unexpected debt is a marathon, not a sprint. By understanding the situation, taking proactive steps to address the debt, and diligently rebuilding your credit, you can regain control and strengthen your financial standing. It’s about learning from the challenge and emerging more financially resilient.