As the digital asset landscape continues to evolve, understanding the tax implications across different jurisdictions is crucial for investors. For many, the idea of holding or trading cryptocurrencies without incurring capital gains tax is incredibly appealing. Based on current information as of August 3, 2025, here are five countries that notably do not levy capital gains tax on cryptocurrency transactions.

1. Portugal

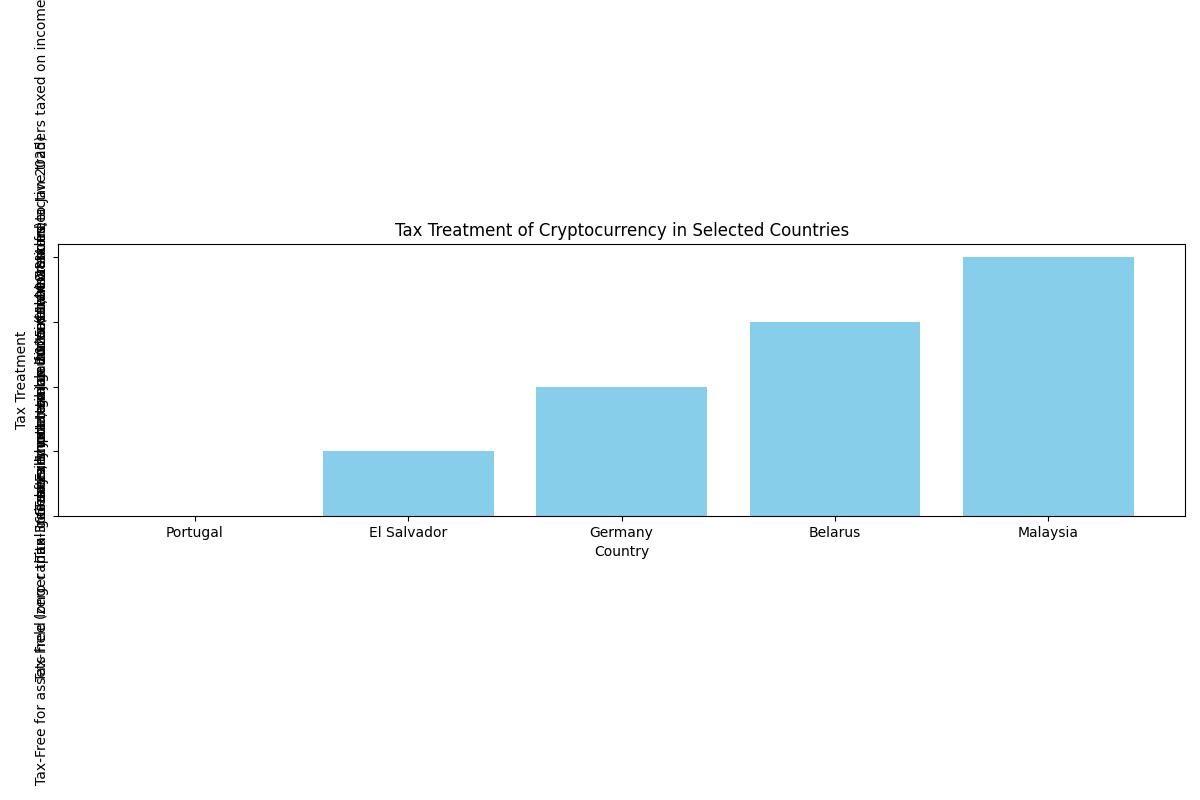

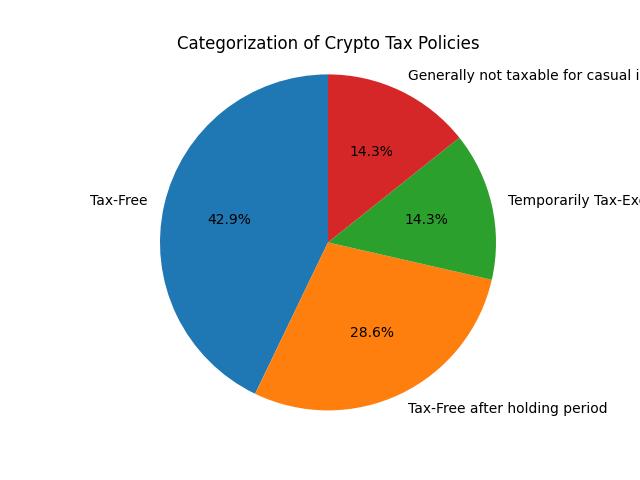

Portugal has long been a popular destination for crypto enthusiasts due to its favorable tax regime. For individuals, cryptocurrency is generally treated as a form of foreign currency, and as long as it’s not considered a financial asset obtained through illegal activities or a result of mining operations that are classified as commercial activity, profits from selling or exchanging crypto are typically not subject to capital gains tax. This means many everyday transactions and investments can be made without tax liability.

2. El Salvador

Famous for adopting Bitcoin as legal tender, El Salvador offers a unique environment for cryptocurrency. Any transaction made in Bitcoin, or any other cryptocurrency recognized by the government, is exempt from capital gains tax. This policy aims to encourage the adoption and use of digital currencies within the country, making it a potentially attractive spot for those looking to engage deeply with crypto.

3. Germany

Germany’s approach to crypto taxation can be quite beneficial, especially for long-term holders. While the specifics can be complex, generally, if you hold a cryptocurrency for more than one year, any profit made from its sale is considered tax-free, regardless of the amount. This one-year holding period applies to capital gains, offering a significant advantage for strategic investors.

4. Belarus

Belarus took a bold step in 2017 by legalizing and exempting income from cryptocurrency operations from personal income tax and corporate tax until January 1, 2025. This extensive tax exemption covers mining, trading, and other forms of crypto transactions, making Belarus a notable jurisdiction for crypto activity, though it’s important to stay updated on any future policy changes beyond 2025.

5. Malaysia

In Malaysia, the tax treatment of cryptocurrency is nuanced. As of my last update, profits derived from the trading of cryptocurrencies on recognized digital asset exchanges are generally not considered taxable income, provided the activities are not carried out with profit-making as the primary objective and do not constitute a business. This means casual investors or traders might find their gains exempt from capital gains tax.

A Word of Caution

While these countries offer potentially tax-free environments for cryptocurrency, tax laws are subject to change. It’s always wise to consult with a qualified tax professional familiar with both your local jurisdiction and the specific laws of any country you are considering for your crypto investments. My aim here is to share information that might help you navigate the crypto landscape, but this is not financial or tax advice. Always do your own research and consult with experts.