It’s a common worry: realizing a loved one, like my mom who’s 48, hasn’t saved as much for retirement as we’d hoped. With around $15,000 saved, it might seem daunting, but it’s not too late to make a significant impact.

Many adults find themselves in a similar situation. Life happens – expenses, family needs, and perhaps a lack of early planning can leave retirement savings a bit behind schedule. The good news is that proactive steps taken now can make a real difference, especially for someone still in their late 40s.

One effective strategy is to open a Roth IRA. Unlike traditional IRAs, contributions to a Roth IRA are made with after-tax dollars, meaning qualified withdrawals in retirement are tax-free. For someone like my mom, who might be in a lower tax bracket now than she anticipates being in retirement, this can be a huge advantage down the line. The maximum contribution limit for IRAs changes annually, but even consistently contributing the maximum allowed can build up savings substantially over time.

So, where should that money go? Investing in low-cost index funds is often a smart move. These funds track a broad segment of the market, like the S&P 500, offering instant diversification. Instead of trying to pick individual winning stocks, which is incredibly difficult and time-consuming, index funds provide exposure to the overall market’s growth. This approach is generally less risky than active trading and has historically delivered solid returns over the long term.

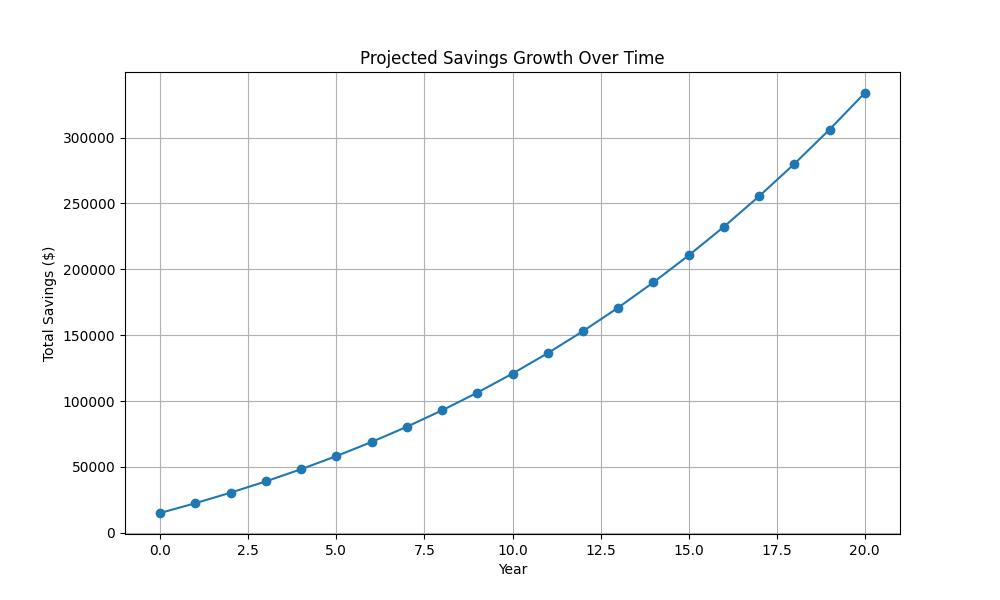

For example, if we consider a hypothetical scenario where your mom contributes $6,000 annually (the current IRA limit for under 50) and achieves an average annual return of 7% over the next 15-20 years, her initial $15,000 could grow significantly. Let’s look at the numbers:

- Initial Savings: $15,000

- Annual Contribution: $6,000

- Assumed Average Annual Return: 7%

After 15 years, her savings could potentially reach over $200,000. After 20 years, it could be closer to $300,000.

This isn’t about getting rich quick; it’s about smart, consistent saving and investing. The key is to start now, make regular contributions, and let the power of compounding work its magic. It’s never too late to take control of your financial future, and helping a loved one do the same is a rewarding journey.