Hey everyone, Kenji here.

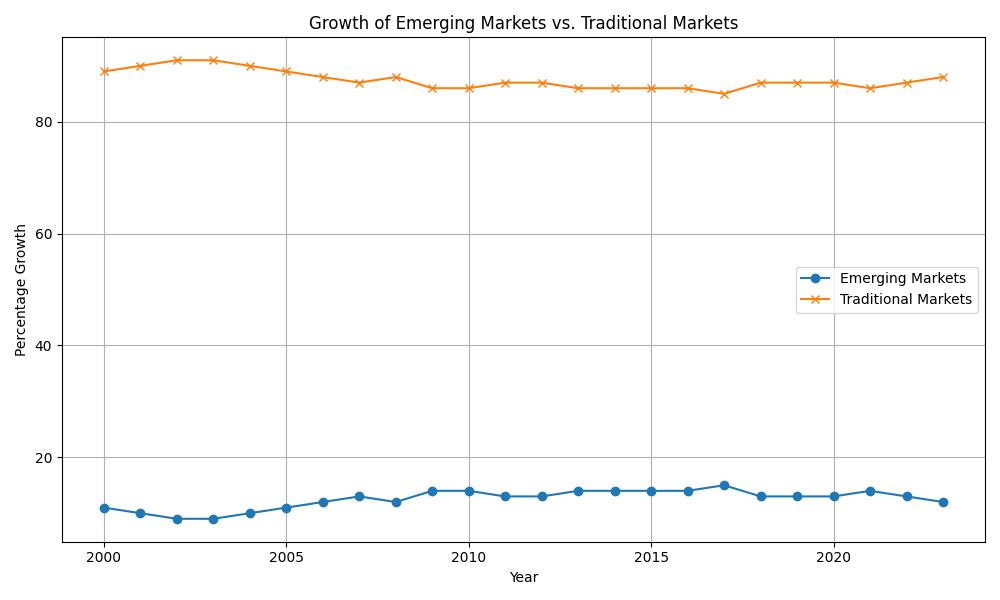

Life throws curveballs, and sometimes those curveballs involve significant financial shifts, like managing an inheritance or helping a parent with their finances. These aren’t always straightforward situations, and they can feel overwhelming. My background is in financial analysis, especially in areas like emerging markets and cryptocurrency, which are often complex and fast-moving. But the principles of managing risk, understanding value, and making informed decisions apply universally, even when dealing with more traditional, yet still complicated, financial matters.

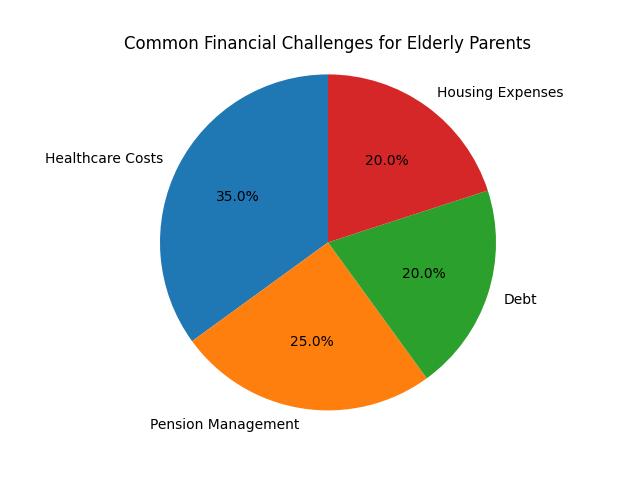

When you’re faced with managing a parent’s finances, for example, it’s about more than just numbers. It’s about understanding their needs, their assets, and their liabilities. Often, this involves navigating things like pensions, social security, potential healthcare costs, and existing investments or debts. It requires a clear, organized approach, much like analyzing a new market.

Think about inheritance. It can be a sudden influx of assets, but it also brings responsibilities. Understanding tax implications, potential investment strategies for new capital, and how these assets fit into your overall financial picture is crucial. It’s not just about receiving something; it’s about managing it wisely for the future.

My experience in volatile markets has taught me the importance of a few key things:

- Information is Key: Before making any decisions, gather all the facts. Understand the details of the inheritance, the specifics of your parent’s financial situation, or the terms of any debt.

- Strategy Over Emotion: It’s easy to get caught up in the emotional aspects of these situations. However, a clear, rational strategy is essential for making sound financial choices. This means setting clear goals and outlining steps to achieve them.

- Diversification Matters: Just as in investing, where you wouldn’t put all your eggs in one basket, diversifying your approach to managing complex finances can help mitigate risk. This might mean seeking advice from different professionals or spreading out how you manage assets.

- Long-Term Perspective: Especially when dealing with family finances or inheritance, thinking long-term is vital. How will these decisions impact your future and the future of your family?

While my usual focus is on the dynamic world of crypto and emerging markets, the core principles of diligent research, risk assessment, and strategic planning are universal. Whether you’re analyzing a new digital asset or helping a loved one navigate their financial journey, a structured and informed approach will serve you best. It’s about building a stable financial future, one informed decision at a time.

Disclaimer: This post is for informational purposes only and does not constitute financial, legal, or tax advice. Always consult with qualified professionals for your specific situation.