Losing a sibling is incredibly difficult. When that loss is sudden, the emotional toll is immense, and dealing with practical matters can feel overwhelming. If your sister recently passed away and you’ve been named the sole beneficiary of her 401(k), it’s natural to wonder about the next steps. I’m Kenji Ito, and while I focus on emerging markets and cryptocurrency, the principles of managing financial assets are universal. Let’s break down what you need to know about handling an inherited 401(k).

Understanding Your Role as Beneficiary

As the sole beneficiary, you have specific rights and responsibilities concerning your sister’s 401(k). The first step is to contact the plan administrator. This is typically the company where your sister worked or the financial institution that manages her retirement plan (like Fidelity, Vanguard, or Schwab). You’ll need to inform them of her passing and provide a copy of her death certificate. They will guide you through their specific procedures.

Key Decisions You’ll Face

When you inherit a 401(k), you generally have two main options:

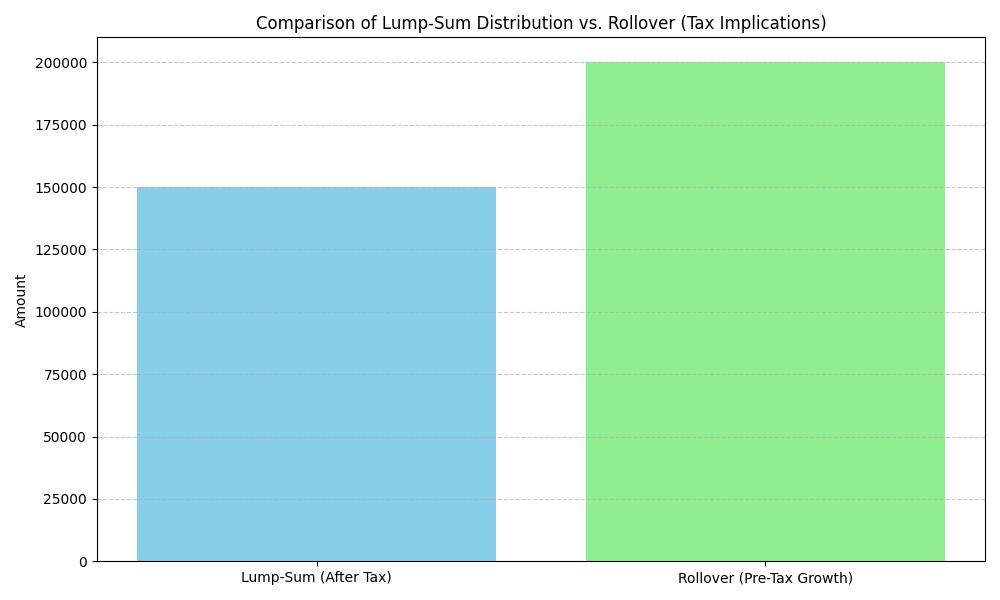

- Take a Lump-Sum Distribution: You can withdraw the entire balance of the account. However, this is often not the most tax-efficient choice. Any amount withdrawn will be subject to ordinary income tax in the year you receive it. For larger sums, this could push you into a higher tax bracket.

-

Roll Over the Funds: This is usually the more advantageous path. You have a couple of ways to roll over the 401(k):

- Into an Inherited IRA: This is a common and often recommended strategy. You can roll the 401(k) funds into an Inherited IRA set up in your name. This gives you more control over your investment choices and allows you to manage the distributions according to IRS rules.

- Into Your Own 401(k) or IRA (if allowed): In some specific circumstances, if the 401(k) plan allows it, you might be able to roll the funds directly into your own existing retirement accounts. This is less common, so you’ll need to check with the plan administrator.

Distribution Rules: The SECURE Act’s Impact

The rules for how quickly you must take distributions from an inherited retirement account were updated by the SECURE Act. For most beneficiaries who are not the deceased’s spouse, there’s generally a 10-year rule. This means the entire account balance must be distributed by the end of the tenth year following the year of the original account holder’s death. If your sister passed away in 2025, the account must be fully distributed by December 31, 2035. Your plan administrator will be able to clarify the specific timeline applicable to your situation.

Investment Management

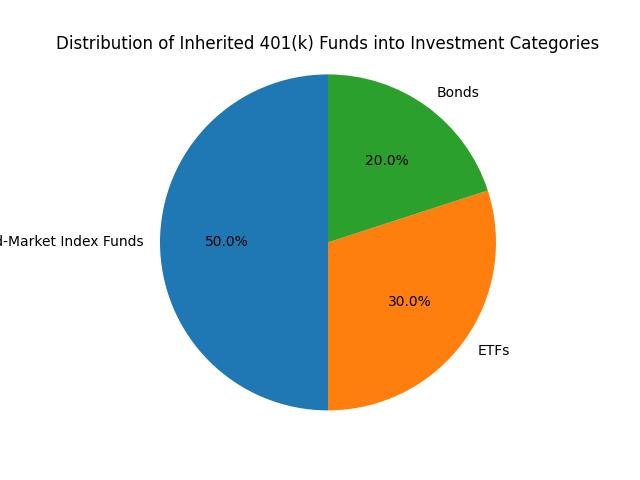

Once the funds are in an inherited account (like an Inherited IRA), you’ll need to decide how to invest them. This is where you can apply sound investment principles. Consider your own financial goals, risk tolerance, and time horizon. Given my background in financial analysis and trading, I always emphasize diversification and understanding the assets you hold. While I cannot provide financial advice, exploring options like broad-market index funds or ETFs can be a prudent way to manage these funds for long-term growth.

Important Considerations:

- Taxes: Understand the tax implications of any distributions you take. Consult with a tax professional if you’re unsure.

- Deadlines: Be mindful of the distribution deadlines to avoid penalties.

- Professional Advice: Navigating these situations can be complex. It’s often beneficial to speak with a financial advisor and a tax professional who can provide personalized guidance based on your specific circumstances.

Dealing with a deceased loved one’s financial affairs is never easy, but taking informed steps with their 401(k) can help ensure their savings continue to serve a purpose. This is a moment for careful consideration and strategic planning.