As someone who spends a lot of time analyzing markets, from the fast-paced world of crypto to the steady rhythm of stocks, I’m always looking for ways to build a robust investment portfolio. Diversification is key, and real estate often comes up as a strong contender. It’s not just about owning a house; it’s about understanding how property can fit into a broader financial picture.

Let’s talk about a scenario: you plan to eventually turn your primary residence into a rental property. This is a smart way to think about real estate not just as a home, but as a potential income-generating asset. It’s a long-term play, and like any investment, it requires planning.

Why Diversify with Real Estate?

Stocks and bonds are great, but they can sometimes move in the same direction. Real estate, on the other hand, often behaves differently. Its performance can be influenced by local economic factors, interest rates, and demand for housing, which don’t always correlate directly with the stock market. Adding property to your mix can smooth out the overall volatility of your portfolio.

Think of it this way: if the stock market takes a dip, rental income from a property might remain stable, providing a buffer. Conversely, if property values decline, your stock investments might still be growing.

Using Investments for a Down Payment

Sometimes, the quickest way to get into the real estate market is by leveraging existing investments. Selling some stocks or even crypto assets to fund a down payment is a strategy many consider. It’s a calculated move. Before you hit that sell button, consider:

- Capital Gains Tax: Selling profitable investments means you’ll likely owe taxes on the gains. Factor this into your calculations.

- Opportunity Cost: By selling, you’re giving up potential future growth from those assets. Is the real estate opportunity compelling enough to justify this?

- Market Timing: Selling low on investments to buy property might not be ideal. Ideally, you want to sell investments when they are performing well.

From Homeowner to Landlord

When you’re ready to transition your home into a rental, there are several considerations:

- Market Research: Understand local rental rates, vacancy rates, and tenant demand. What type of property is most sought after in your area?

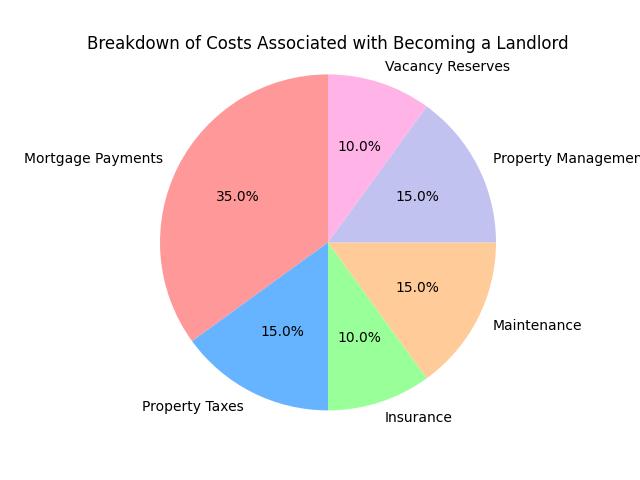

- Property Management: Will you manage the property yourself, or hire a professional? This impacts your time commitment and expenses.

- Financing: If you’re not paying cash, you’ll need a mortgage. Your ability to secure one will depend on your income, credit history, and the property’s potential rental income.

- Regulations: Familiarize yourself with landlord-tenant laws in your jurisdiction. These can cover everything from lease agreements to eviction processes.

The Bigger Picture

Integrating real estate into a diversified portfolio isn’t just about buying a property. It’s a strategic decision that involves understanding market dynamics, personal financial goals, and the practicalities of property ownership. By carefully considering these factors, you can leverage real estate as a powerful tool to build long-term wealth.