Planning your finances can feel like a juggling act, especially when you have a good income, a mortgage, existing investments, and dreams of buying another property. It’s a common situation, and it brings up some fundamental questions about how to best manage your money for both today and tomorrow.

Let’s break down a typical scenario. Imagine someone earning a high income, with a mortgage on their current home. They’ve got investments, maybe in stocks or ETFs, and they’re also thinking about saving for a down payment on a second property. This isn’t just about saving more; it’s about making smart decisions about where that money goes and how to protect it.

Understanding Your Financial Picture

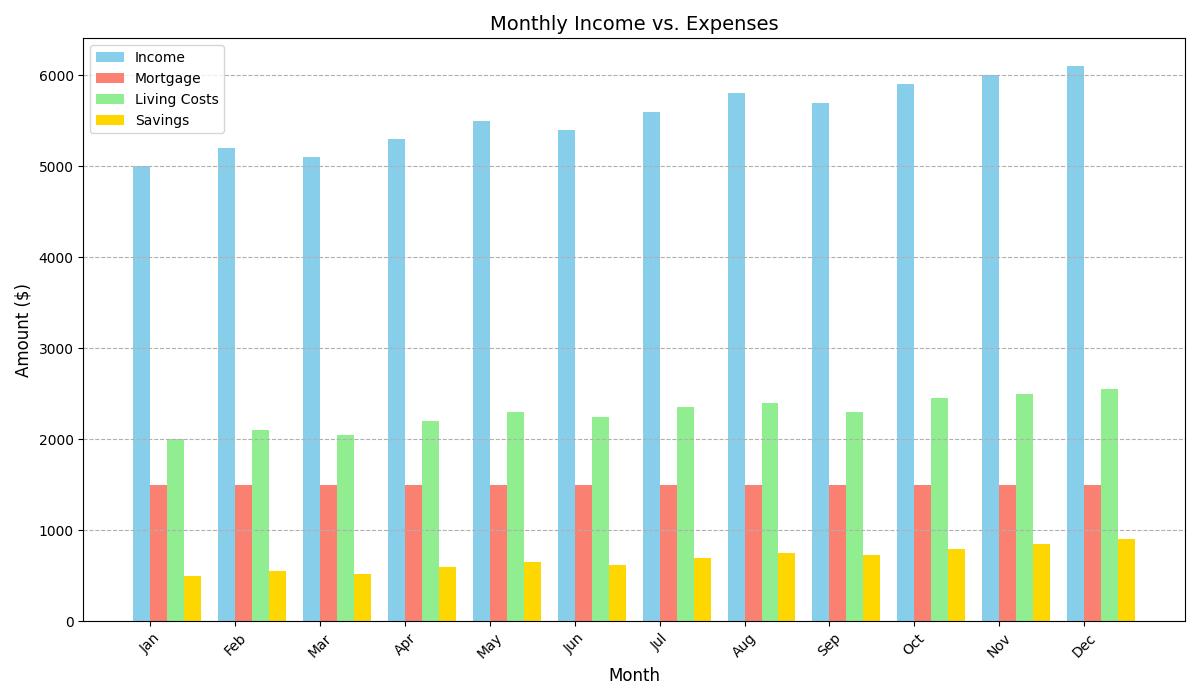

First, you need a clear view of where you stand. This means knowing your income, your expenses, your assets (like investments and savings), and your liabilities (like your mortgage). For someone with a high income and a mortgage, the mortgage is often the largest liability. The interest rate on this mortgage is a key factor. If it’s a low rate, it might make sense to prioritize investing over aggressively paying down the principal.

Investment Choices: Growth vs. Security

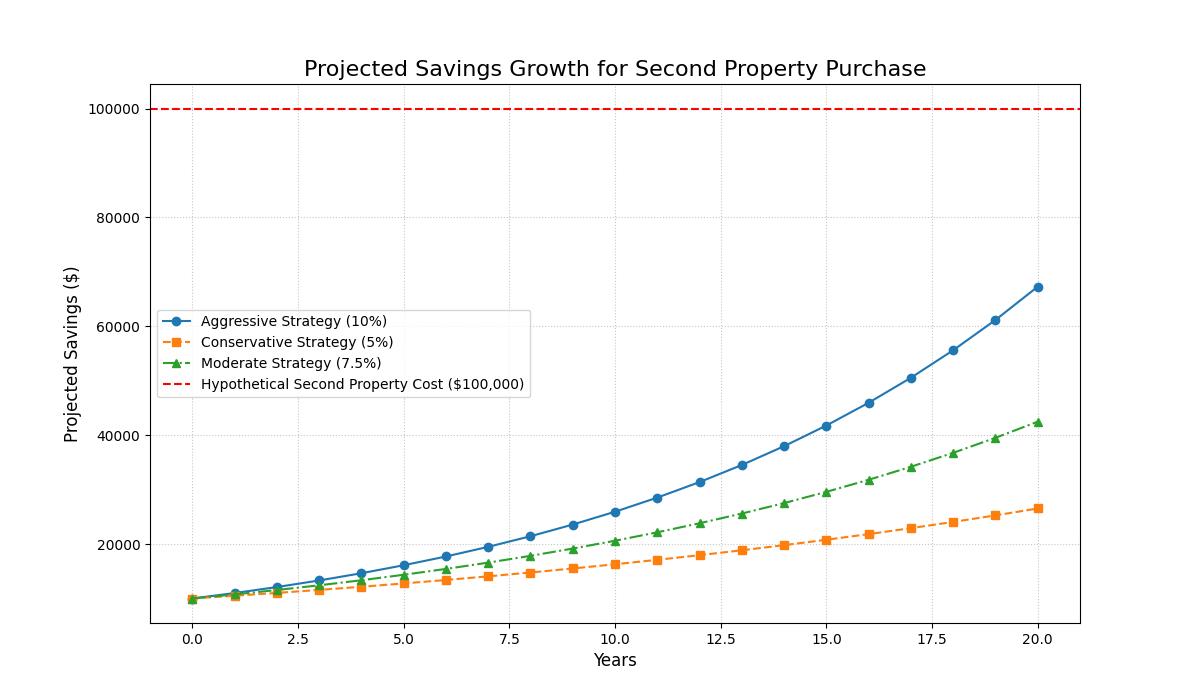

When you have extra capital, you face choices. Do you put it into your investments to chase potential growth, or do you use it to reduce debt or build up emergency savings? If you’re eyeing a future house purchase, you also need to consider the timeline. Money needed in the short term (say, less than 3-5 years) is usually best kept in lower-risk, more accessible accounts, like high-yield savings accounts or short-term bonds. This prevents you from having to sell investments at a loss if the market is down when you need the cash.

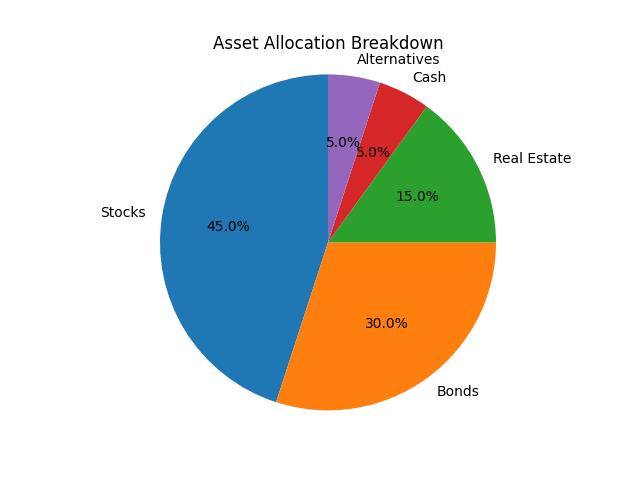

For longer-term goals, investing in diversified portfolios remains a cornerstone. This could mean broad market ETFs, sector-specific funds, or even exploring asset classes that align with your risk tolerance and market outlook. Given my own focus, I often look at emerging markets or even certain FinTech opportunities, but it’s crucial to understand the specific risks involved.

Risk Management: Beyond Diversification

Risk management isn’t just about diversifying your investments. It’s also about protecting your income. For someone with a high income and financial obligations like a mortgage, income protection is paramount. This includes having adequate insurance: life insurance, disability insurance, and health insurance. A sudden job loss or health crisis can derail even the best-laid financial plans.

Consider your emergency fund. Experts often recommend having 3-6 months of living expenses saved. For someone with a high income and a mortgage, this buffer is even more critical, as your monthly outflows are likely substantial. This fund should be easily accessible and kept separate from your investment accounts.

The Future House Purchase

When planning for a second property, the down payment is key. How aggressively you save for it depends on your overall financial health and your timelines. If you’re aiming to buy within a few years, a significant portion of your savings might need to be allocated to more conservative vehicles. If it’s a longer-term goal (5-10+ years), you might be able to afford to invest more aggressively for the down payment, understanding that market fluctuations could impact the final amount available.

Key Takeaways

- Know Your Numbers: Get a clear picture of your income, expenses, assets, and liabilities.

- Align Savings with Timeline: Short-term goals need safe, accessible funds. Long-term goals can handle more market risk.

- Protect Your Income: Ensure you have appropriate insurance coverage.

- Build a Solid Emergency Fund: This is your safety net.

Navigating these financial decisions is a continuous process. By understanding your situation, carefully choosing where your money goes, and managing risks, you can build a strong financial future. Remember, this is for informational purposes, and what works best for you might differ based on your unique circumstances.