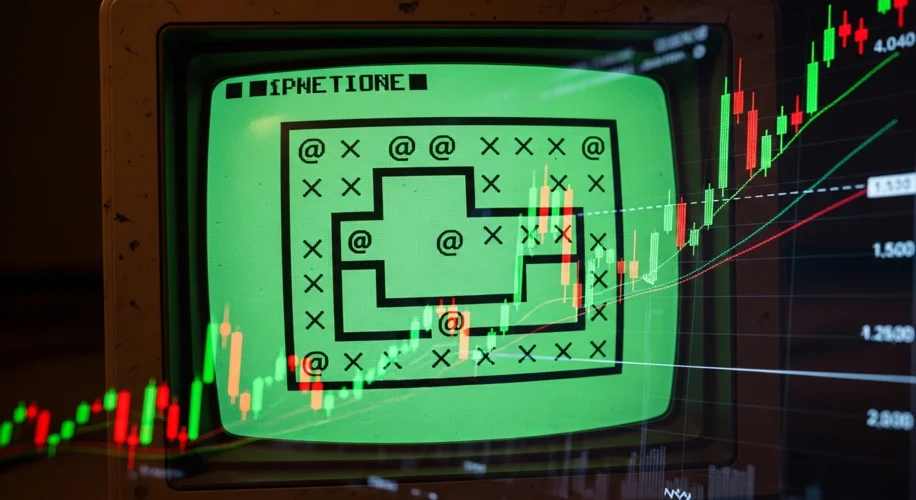

Remember those clunky, text-based games you played on early computers? Games like Zork or Colossal Cave Adventure, programmed in BASIC, might seem like ancient history. But for me, they were the first glimpses into something powerful: algorithmic thinking. And it turns out, those early digital challenges hold surprising lessons for how we approach trading and financial modeling today.

I started my journey into finance by looking at market trends, data, and the underlying mathematics. But my fascination with how things work, how to predict outcomes, and how to build systems that can achieve a goal goes way back. It goes back to sitting in front of a screen, typing lines of code into a BASIC interpreter, trying to make a digital opponent play fair, or even cheat.

Think about it. Even the simplest BASIC game needed a set of rules – an algorithm – to function. How does the computer decide its next move? How does it react to your input? These weren’t complex neural networks, but they were the foundational building blocks of decision-making logic. Players, even kids like me, quickly learned to analyze these rules. We’d figure out the patterns, exploit loopholes, or develop counter-strategies. This is exactly what successful traders do.

We’re constantly analyzing market data, identifying patterns, and building algorithms – whether explicitly through code or implicitly through our trading strategies – to make decisions. The goal is the same: to predict outcomes and maximize returns based on a defined set of rules and inputs. The mathematics behind financial models, especially in areas like quantitative trading or algorithmic trading, are just more sophisticated versions of the logic that made those old BASIC games tick.

Consider the concept of a winning strategy. In those early games, the ‘win’ condition was clear. In trading, it’s profit. To achieve that win, you needed to understand the game’s mechanics. Were there predictable sequences? Was there an element of chance? How did the opponent’s behavior change based on your actions?

This is akin to understanding market dynamics. Is a certain indicator more reliable in specific conditions? How does investor sentiment, the ‘opponent’ in a way, react to news? The core principle remains: understanding the system and devising a strategy within its rules.

The jump from a simple BASIC game to a modern financial algorithm might seem vast, but the underlying principles are connected. Both involve:

- Logic and Rules: Defining how the system operates.

- Data Input: Using available information to inform decisions.

- Pattern Recognition: Identifying trends or predictable behaviors.

- Strategic Execution: Applying a plan to achieve a desired outcome.

My exploration of financial markets has always been about dissecting systems, finding the logic, and optimizing for results. It’s a pursuit that started in the days of floppy disks and blocky graphics, teaching me that even in the simplest of digital worlds, understanding the rules is the first step to mastering the game. And that’s a lesson that still holds true today, whether you’re battling a dragon on screen or navigating the complexities of the financial markets.