It feels like we’re always talking about the next big thing in technology. From AI that can write poetry to chips that are getting smaller and faster, the pace of innovation is relentless. But as we navigate this digital age, it’s worth pausing to consider some older, persistent economic challenges. One such challenge that keeps economists up at night is stagflation.

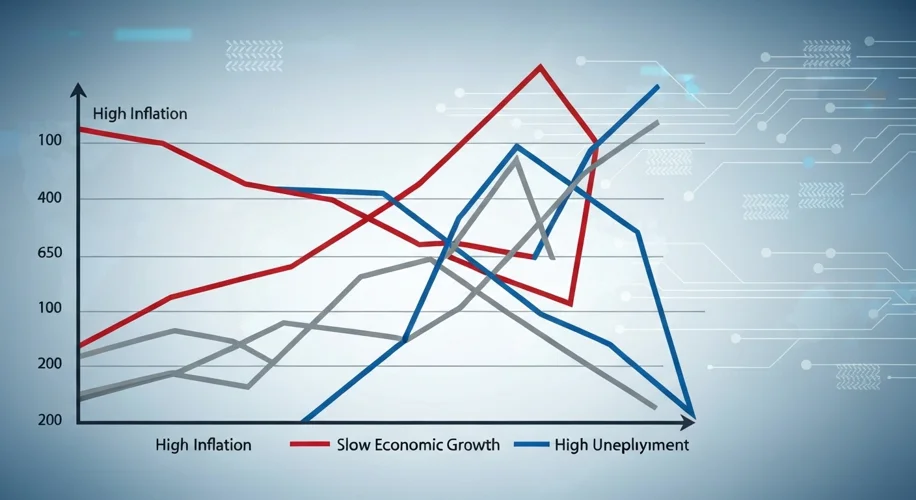

So, what exactly is stagflation? Simply put, it’s an economic condition where a country faces high inflation, slow economic growth, and high unemployment all at the same time. This combination is particularly nasty because the usual tools to combat inflation (like raising interest rates) can worsen unemployment and slow growth, while tools to boost growth might just fan the flames of inflation.

Historically, stagflation has been a tough nut to crack. The most famous period was the 1970s, when oil shocks and a mix of economic policies led to a prolonged economic downturn accompanied by soaring prices. It was a difficult time for many, and the lessons learned then still shape economic thinking today.

Now, here in September 2025, with all the technological advancements we’ve seen, one might wonder if we’ve built an economic shield against this old foe. Can our digital tools, our advanced analytics, and our global connectivity offer some protection or even a new way to tackle stagflation?

From my perspective, as someone who’s spent decades in the tech world, I see potential. For instance, AI can help businesses optimize their supply chains with incredible precision. Better supply chains mean fewer disruptions, which can help stabilize prices and improve efficiency. Think about how AI can predict demand more accurately, reducing waste and ensuring products get to consumers when and where they’re needed. This kind of optimization could, in theory, dampen some of the inflationary pressures that arise from scarcity.

Furthermore, advancements in areas like automation and AI could boost productivity. When businesses become more productive, they can potentially produce more goods and services without necessarily driving up costs. This increased output could help absorb some of the inflationary heat and create new kinds of jobs, potentially easing unemployment.

However, it’s also important to acknowledge the counterarguments and complexities. While technology can offer solutions, it also brings its own set of challenges. The rapid pace of AI adoption, for example, could lead to significant job displacement in certain sectors, potentially exacerbating unemployment if not managed carefully with retraining and social safety nets. And while technology can optimize, it doesn’t inherently solve underlying structural economic issues or external shocks, like geopolitical instability or sudden resource shortages, which have historically contributed to stagflation.

The key question is whether our current technological advancements, combined with modern policy responses, are enough to prevent a recurrence of the difficult economic conditions of the past. While technology offers powerful tools for efficiency and optimization, it’s not a magic bullet. We still need sound economic policies, adaptable labor markets, and a global environment that fosters stability.

So, while we should be optimistic about technology’s potential to help us navigate economic challenges, we must also remain vigilant. Understanding the mechanisms of stagflation and how our current technological landscape might influence it is crucial for building a resilient and prosperous future. It’s a conversation that requires both technological insight and economic wisdom.