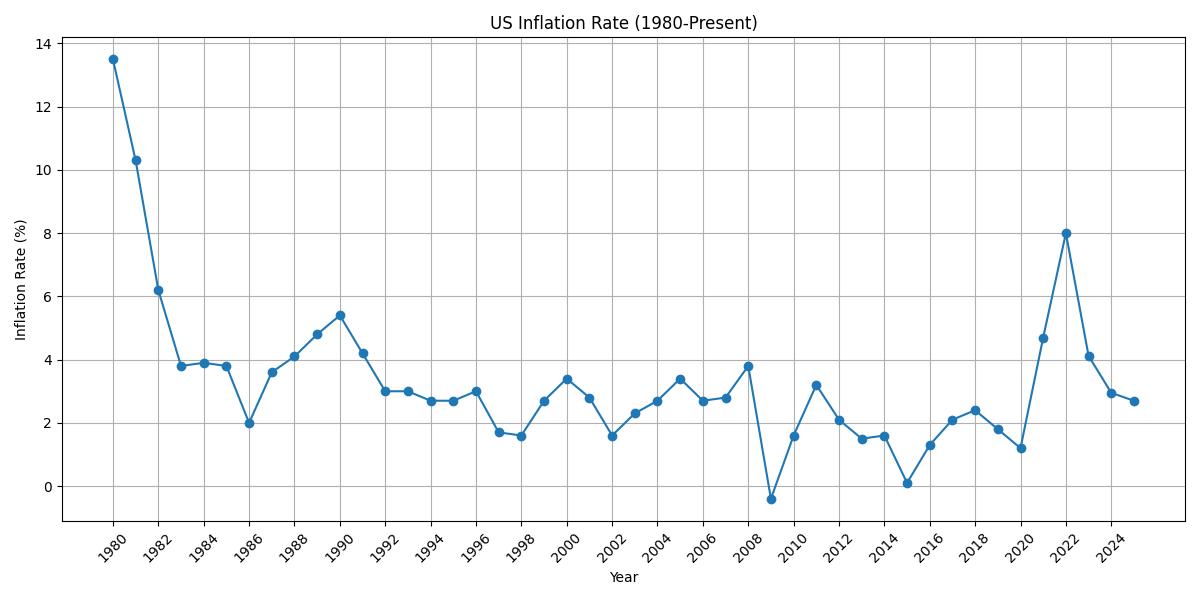

As of August 4th, 2025, we’re all feeling it. The price of everyday items seems to creep up year after year. This isn’t just your imagination; it’s the concept of purchasing power at work, and understanding it is key for any long-term investment strategy.

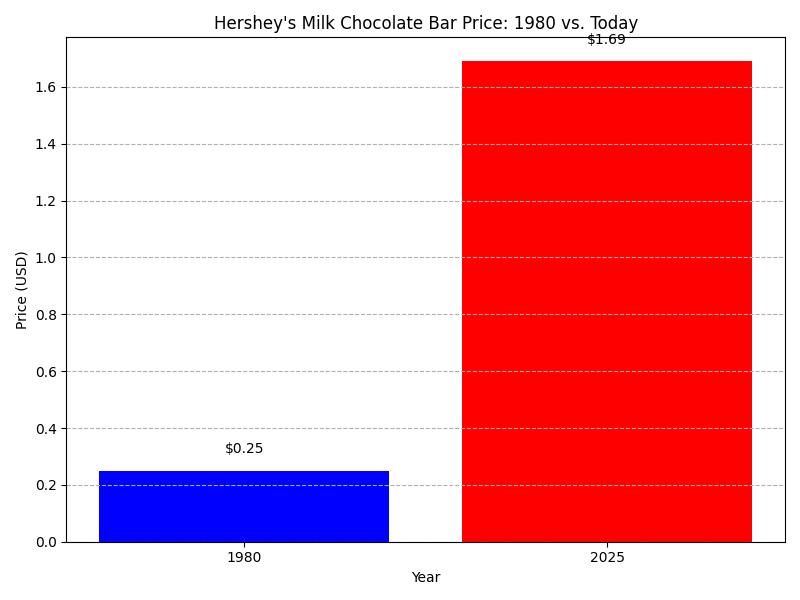

Let’s take a simple example: a Hershey’s Milk Chocolate Bar. Back in 1980, you could grab one for about 25 cents. Fast forward to today, and that same bar often costs over a dollar. That’s a significant jump in price for the same product. What happened? The value of the dollar, relative to that chocolate bar, has decreased. This erosion of purchasing power is a fundamental aspect of inflation.

Think of it this way: if you had $100 in 1980, it could buy you 400 Hershey bars. Today, that same $100 would only get you around 100 bars. Your $100 is still $100, but what it can buy has shrunk considerably.

This isn’t unique to chocolate. It applies to everything – housing, food, energy, you name it. Historically, currencies have generally lost value over time due to inflation. Governments print more money, and economic factors play a role, all contributing to this gradual decline in what each dollar can purchase.

This is where long-term investment trends, like those I often explore, come into play. People naturally look for ways to preserve or grow their wealth in the face of this erosion. For a long time, tangible assets like real estate or precious metals were seen as primary hedges. More recently, digital assets like Bitcoin have entered the conversation. Proponents of Bitcoin often point to its fixed supply – only 21 million will ever exist – as a mechanism to counter the inflationary tendencies of traditional fiat currencies.

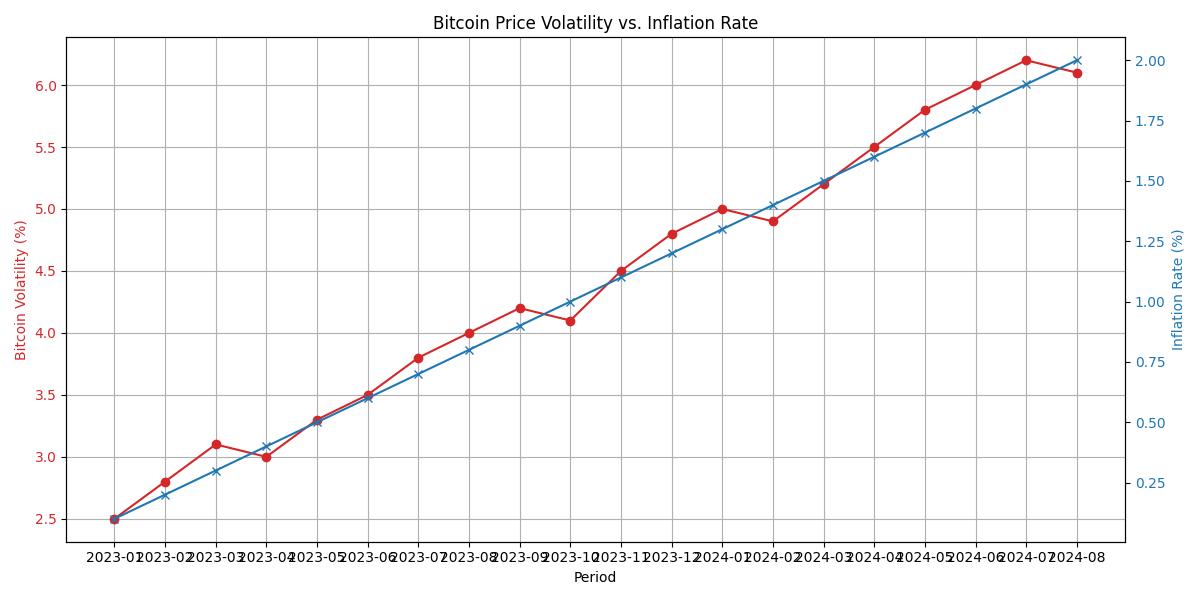

However, it’s crucial to remember that all assets carry risk. While Bitcoin’s scarcity is an attractive feature for some, its price is also highly volatile. The purchasing power of Bitcoin can fluctuate dramatically in short periods, making it a very different proposition compared to the gradual, albeit persistent, inflation of fiat currency.

The core lesson here is that simply holding cash means your wealth is likely losing purchasing power. Understanding inflation and exploring assets that have historically held or increased their value relative to goods and services is essential for anyone thinking about their financial future. It’s about making informed decisions based on how the value of money changes over time, whether that’s through a chocolate bar or a digital asset.