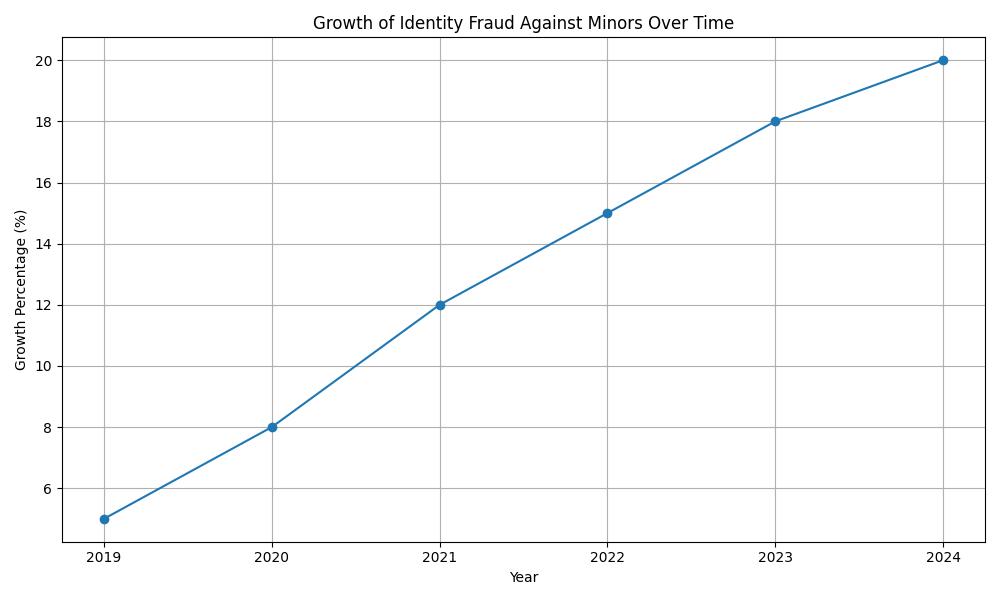

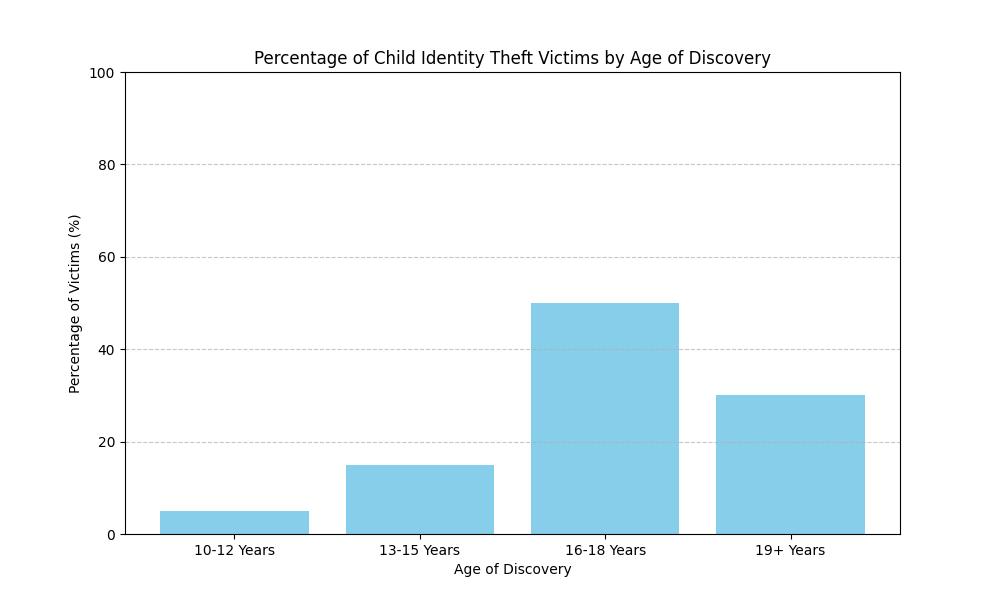

It’s a scary thought, but identity theft can happen to anyone, even children. A child’s Social Security Number (SSN) is a prime target for criminals because it can be used for years before it’s discovered, often when the child applies for a job or credit.

As someone who analyzes markets and trends, I see the importance of proactive measures in finance. Protecting your child’s financial future starts with safeguarding their most sensitive personal information.

Why Children’s SSNs Are Targeted

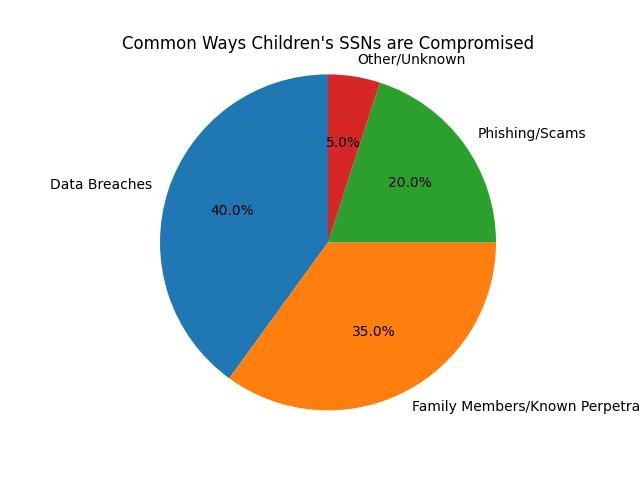

Unlike adults, children typically don’t have credit histories. This makes their SSNs valuable for identity thieves who can open credit accounts, file fraudulent tax returns, or even get medical services in their name. The theft often goes unnoticed until the child is much older, creating a tangled mess of fraudulent activity to unravel.

Proactive Steps to Take Now

- Guard the SSN: Treat your child’s SSN like your own. Don’t carry their Social Security card with you. Store it in a secure place, like a safe deposit box or a locked file cabinet at home.

- Limit Sharing: Only provide the SSN when absolutely necessary, such as for tax purposes or certain government benefits. Ask why it’s needed and if an alternative identifier can be used.

- Check Their Credit Reports: While children usually don’t have credit reports, you can check for any suspicious activity by obtaining a credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually, especially if you suspect a compromise. You can request an “investigative consumer report” under the Fair Credit Reporting Act (FCRA), which allows for a review of information that may not be readily available on a standard credit report.

- Consider an SSN Freeze: In many states, you can place a security freeze on a child’s credit file. This prevents new credit from being opened in their name without your consent. Contact each credit bureau directly to initiate this process.

- Review Account Statements: Even if your child doesn’t have accounts, keep an eye on any official mail they receive. Unexpected bills or credit offers could be red flags.

What to Do If Your Child’s SSN is Compromised

If you discover your child’s SSN has been stolen:

- Report to the FTC: File a report with the Federal Trade Commission (FTC) at IdentityTheft.gov. They provide a personalized recovery plan.

- Contact the Credit Bureaus: Notify all three credit bureaus to place a fraud alert on your child’s file. You’ll need to provide documentation, including the FTC report.

- File a Police Report: Report the theft to your local police department. A police report can be crucial for disputing fraudulent accounts.

- Contact Affected Companies: If you identify specific accounts that were opened fraudulently, contact those companies directly to report the identity theft and close the accounts.

Protecting your child’s financial future is a long-term commitment. By taking these steps, you can build a strong foundation and safeguard them against the devastating effects of identity theft.