As traders and investors, staying informed about macroeconomic factors is key to making smart decisions. One of the most significant influences on markets is the Federal Reserve (the Fed) and its monetary policy, particularly its decisions on interest rates.

So, when is the next Fed meeting? The Federal Open Market Committee (FOMC) typically meets eight times a year to review economic conditions and decide on the direction of monetary policy. The full schedule for these meetings is publicly available on the Federal Reserve’s website.

Why Do Fed Meetings Matter?

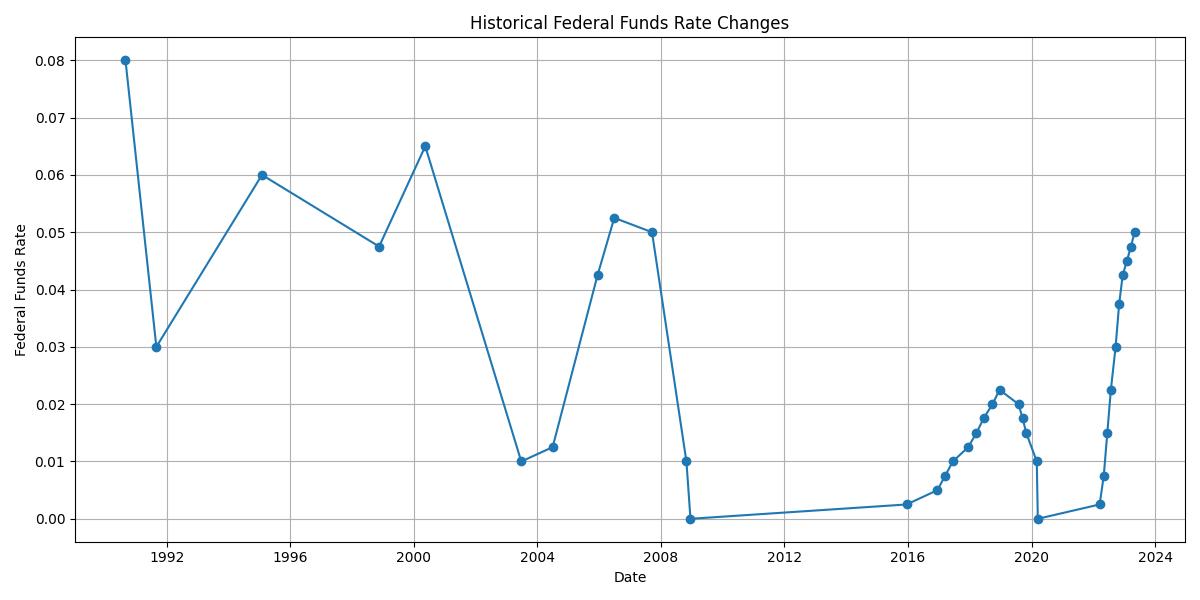

The Fed’s primary tool is the federal funds rate, which is the target rate that commercial banks charge each other for overnight loans. Changes to this rate ripple through the economy, affecting everything from mortgage rates and car loans to business investment and, of course, the stock market.

- Lowering Interest Rates: When the Fed lowers rates, it generally makes borrowing cheaper. This can stimulate economic activity, encouraging consumers to spend and businesses to invest. For investors, lower rates can make stocks more attractive compared to bonds, potentially driving up stock prices.

- Raising Interest Rates: Conversely, when the Fed raises rates, borrowing becomes more expensive. This can help to curb inflation by slowing down economic growth. Higher rates can make bonds more appealing as they offer better yields, and they can also put downward pressure on stock valuations.

Macroeconomic Factors at Play

Before each meeting, analysts like myself scrutinize various economic indicators to anticipate the Fed’s decision. Key data points include:

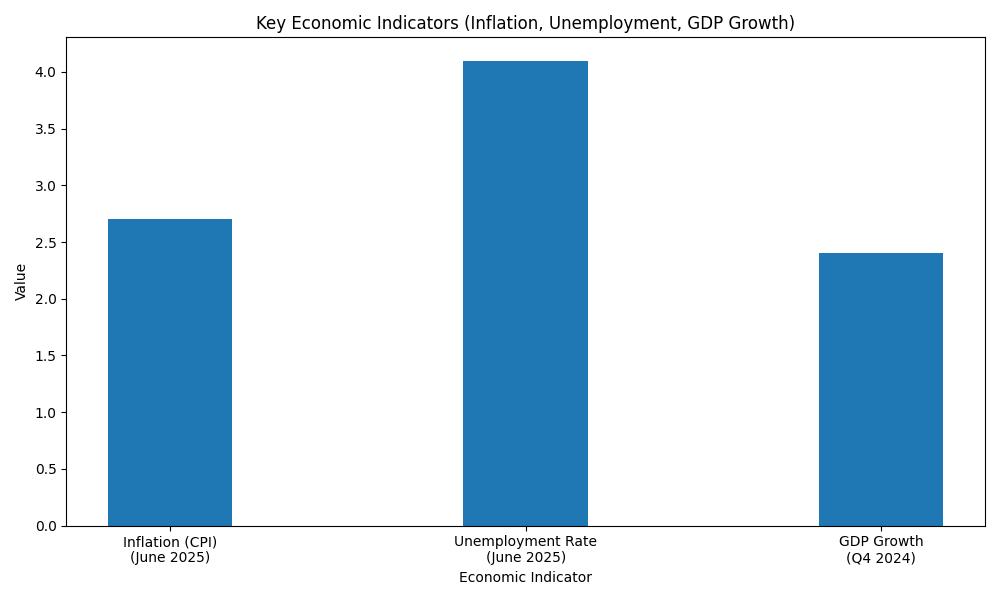

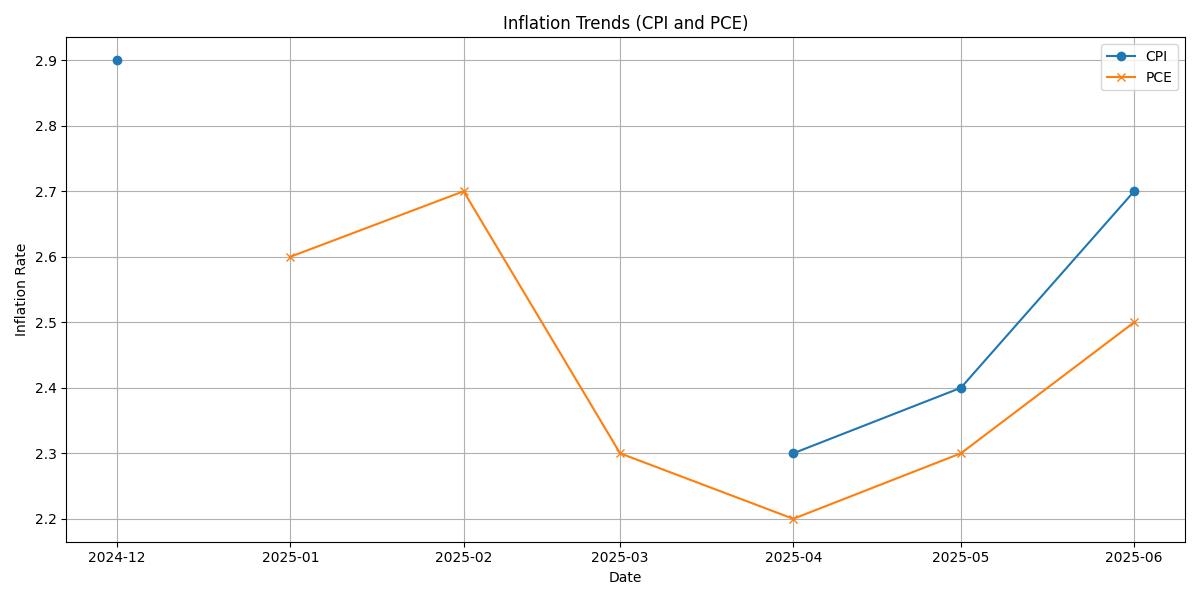

* Inflation: Measured by the Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) price index, high inflation often prompts the Fed to consider rate hikes to cool the economy. Conversely, low inflation or deflationary pressures might lead to rate cuts.

* Employment: The unemployment rate and job growth figures are crucial. A strong labor market can support higher rates, while a weakening one might signal a need for looser monetary policy.

* Economic Growth: Gross Domestic Product (GDP) provides a snapshot of the overall health of the economy. Robust growth can sustain higher rates, while signs of a slowdown may lead to a more dovish stance.

* Consumer Spending and Confidence: These indicators reveal the willingness of consumers to spend, which is a major driver of economic activity.

My Approach

When I analyze these factors, I’m looking for trends that signal the Fed’s likely path. For instance, if inflation data consistently shows signs of cooling and the labor market remains stable but not overheating, it might suggest the Fed could hold rates steady or even consider cuts later on. If inflation remains stubbornly high, however, the pressure to raise rates or keep them elevated will likely persist.

Understanding these dynamics allows us to better position our portfolios. For example, if we anticipate rising rates, we might consider shifting exposure towards assets that tend to perform better in such environments, like certain types of bonds or value stocks. If we foresee rate cuts, growth-oriented assets or dividend-paying stocks might become more appealing.

It’s important to remember that the Fed’s decisions are just one piece of the complex investment puzzle. However, by paying attention to the calendar and the economic data driving their decisions, we can gain a clearer perspective on the forces shaping our financial markets.