The artificial intelligence revolution is here, and it’s hungry for power. As AI models grow more complex and data centers expand to support them, the demand for reliable and efficient energy generation is skyrocketing. This trend presents a unique investment opportunity, especially for those interested in the intersection of technology, infrastructure, and energy.

As someone who keeps a close eye on emerging markets and FinTech, particularly how crypto and data centers interact with energy, this is an area I find particularly compelling. Let’s break down how you can get exposure to the power generation side of this AI boom.

The Growing Demand for AI Data Center Power

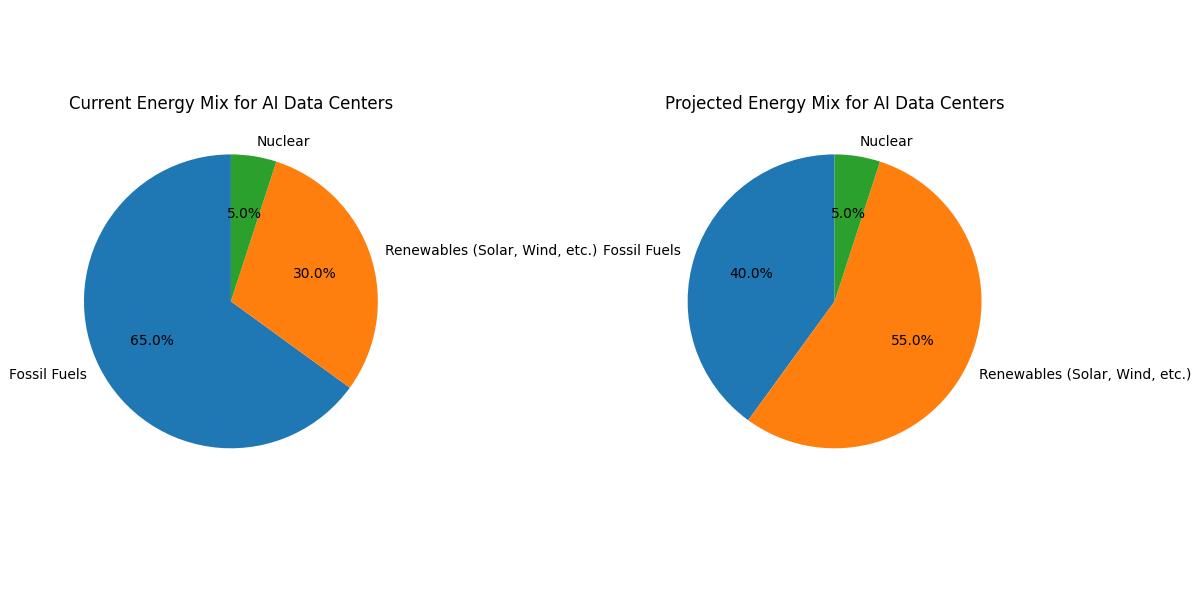

AI computations, especially training large language models, require massive amounts of processing power. This translates directly into a need for more data centers, and consequently, more electricity. These facilities are not just about servers; they’re about the robust infrastructure that keeps them running 24/7. Power generation companies that can supply this demand, whether through traditional or renewable sources, are likely to see significant growth.

Investing in the Energy Backbone

When we talk about AI data centers, we often focus on the chip manufacturers or the software developers. But the unsung hero is the energy that powers it all. Here are a few ways investors can gain exposure:

- Utility Companies with Large Infrastructure Investments: Many large utility companies are investing heavily in expanding their generation capacity and upgrading their grids. Look for utilities that are not only serving major tech hubs but are also actively developing or acquiring new power generation assets, including renewables like solar and wind, or even advanced nuclear projects. Their long-term contracts and essential services make them a relatively stable play.

Independent Power Producers (IPPs): These companies own and operate power generation facilities and sell electricity to utilities or directly to large consumers, like data center operators. IPPs that focus on large-scale projects, particularly those utilizing efficient and modern technologies, could be well-positioned. Some are also exploring ways to integrate battery storage to ensure consistent power delivery, which is crucial for data centers.

Renewable Energy Companies: As the world pushes for more sustainable energy solutions, data centers are increasingly looking for green power sources. Companies specializing in solar farms, wind energy projects, or even emerging technologies like geothermal energy could benefit greatly. Their ability to provide clean, reliable power is a significant advantage.

Infrastructure Funds Focused on Energy: For a more diversified approach, consider infrastructure funds that specifically target energy assets or critical infrastructure. These funds often hold a portfolio of companies involved in power generation, transmission, and distribution, providing a broader exposure to the energy sector’s growth, including its role in supporting tech infrastructure.

Specific Indexes: While less direct, some broad market indexes that include a significant weighting of technology and utility companies will naturally offer some exposure. However, for targeted exposure, one might look for specialized indexes focused on clean energy or infrastructure, although direct AI data center power generation indexes are still nascent.

Key Considerations

- Location: Proximity to areas with high data center concentration and supportive regulatory environments for energy development is key.

- Technology: Companies investing in efficient generation and grid modernization will likely outperform.

- Sustainability: The increasing focus on ESG (Environmental, Social, and Governance) means that renewable energy providers or those with strong sustainability initiatives might have an edge.

The AI boom is not just about code and chips; it’s about the fundamental resources that enable it. By looking at the energy sector, we can find opportunities to invest in the essential infrastructure powering this technological leap forward. It’s a reminder that even in the most cutting-edge industries, the basics of supply and demand, and reliable infrastructure, always matter.

Disclaimer: This post is for informational purposes only and does not constitute financial advice. Always conduct your own research and consider consulting with a qualified financial professional before making any investment decisions.