Investing is a journey, and as you build your portfolio, understanding how taxes impact your gains is crucial. It’s not just about picking the right stocks or crypto projects; it’s also about being smart with the money the government doesn’t take. Today, I want to break down some effective tax-advantaged strategies that can make a real difference in your long-term wealth building.

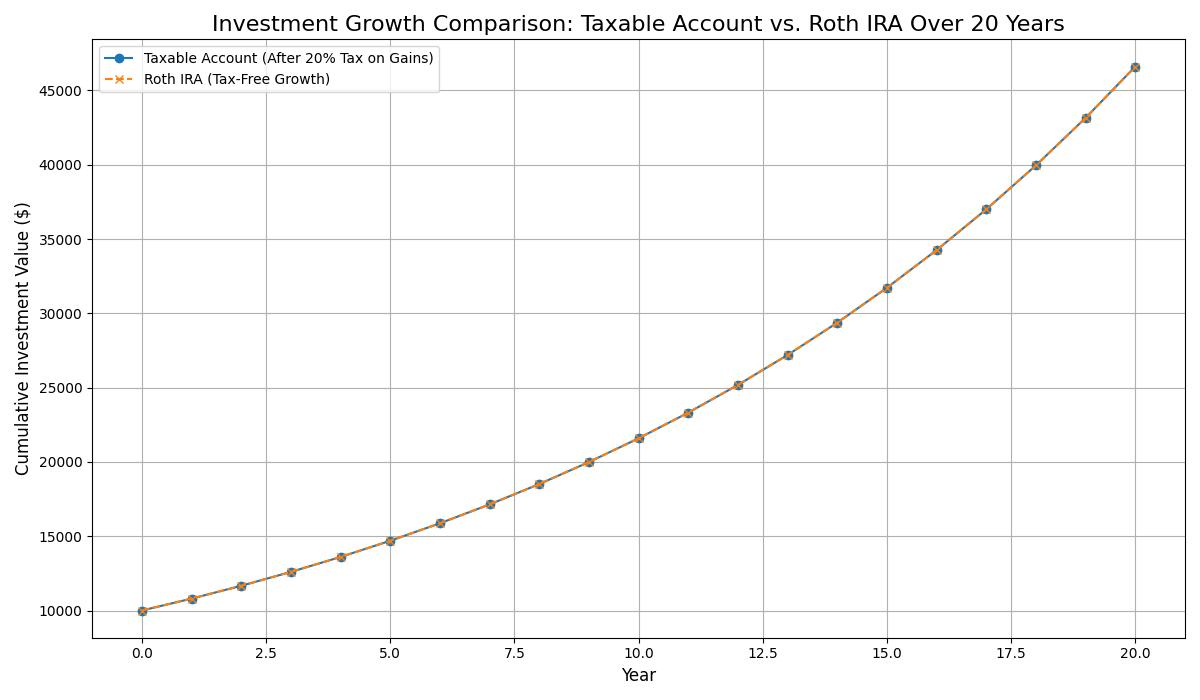

When we talk about tax advantages, we’re generally looking at accounts where your investments grow without being immediately taxed, or where withdrawals are tax-free under certain conditions. This can significantly boost your overall returns compared to a standard taxable brokerage account.

The Power of Retirement Accounts

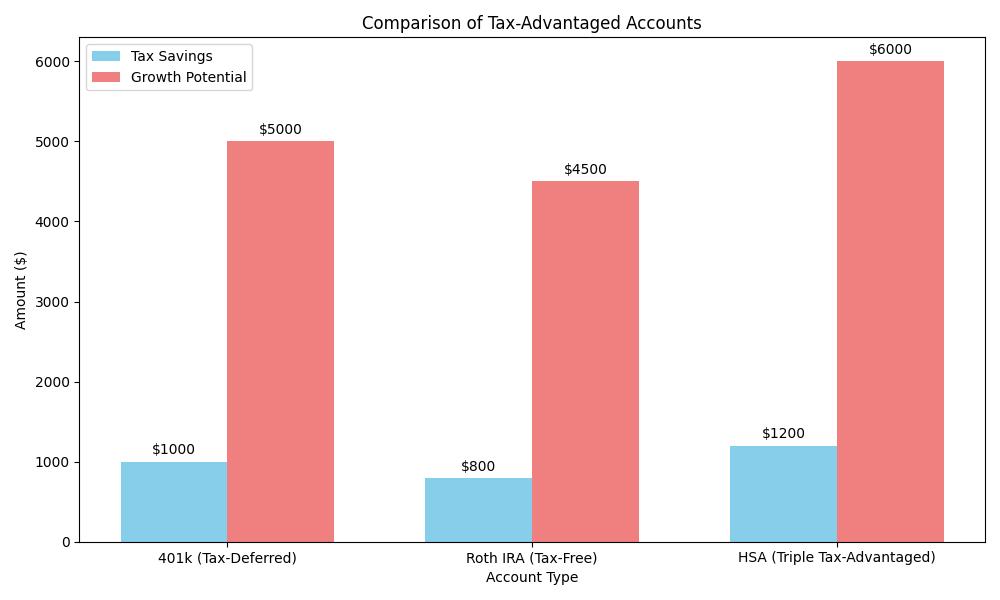

Think of your 401(k) and Roth IRA as your financial superheroes. A traditional 401(k) offers pre-tax contributions, meaning your taxable income is lower today. The money grows tax-deferred, and you pay taxes on withdrawals in retirement, when you might be in a lower tax bracket.

A Roth IRA, on the other hand, uses after-tax dollars. The big win here is that your qualified withdrawals in retirement are completely tax-free. This is incredibly powerful, especially if you expect your tax rate to be higher in the future.

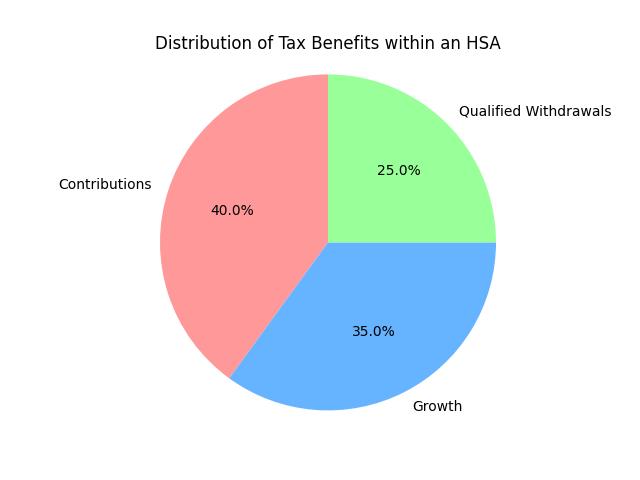

Health Savings Accounts (HSAs): More Than Just Medical

HSAs are often overlooked but are one of the most potent tax-advantaged accounts available. If you have a high-deductible health plan, you’re likely eligible. Contributions are tax-deductible, the money grows tax-free, and qualified medical withdrawals are also tax-free. The