Building a solid financial future often feels like juggling. For many of us, it involves managing a good income, paying down a mortgage, making smart investments, and planning for bigger goals like a future home purchase. It’s a scenario I see frequently, and it’s incredibly relatable.

Let’s break down how to approach this complex, yet achievable, financial landscape.

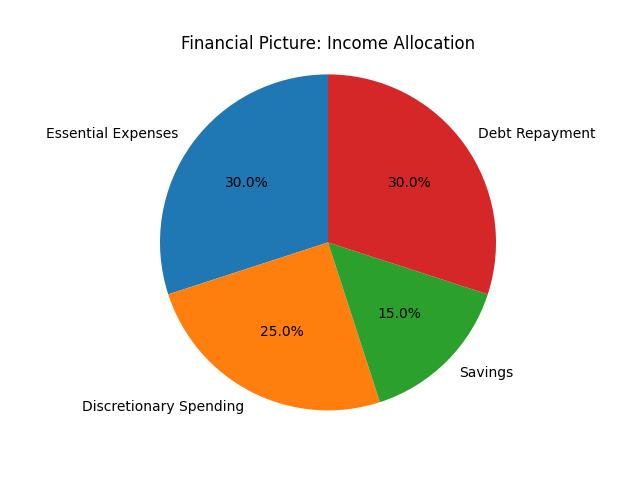

Understanding Your Current Financial Picture

First, get a clear view of where you stand. This means understanding your income after taxes, your monthly expenses, and your debt obligations, especially that mortgage. Knowing your exact cash flow – what comes in and what goes out – is the foundation of any good financial plan.

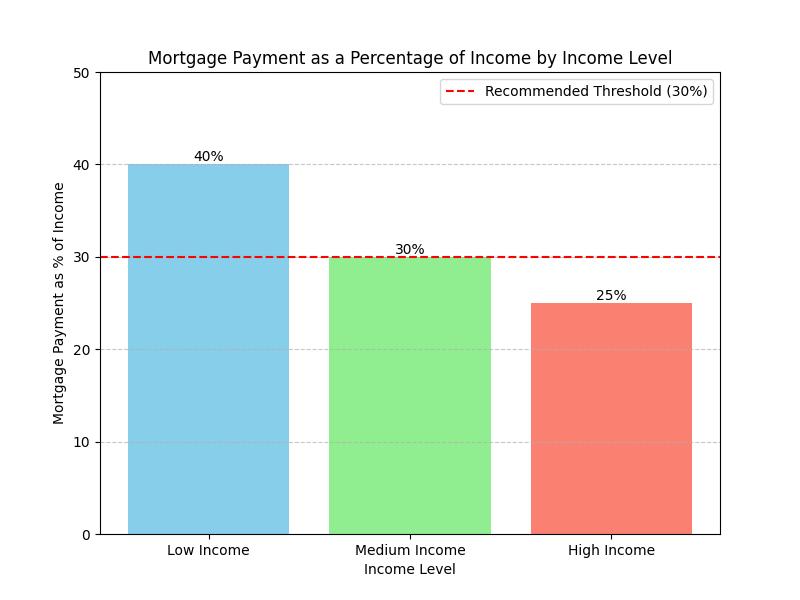

Mortgages: A Necessary Tool, A Long-Term Commitment

A mortgage is often a significant part of homeownership. While it’s a debt, it’s also an investment in an asset. The key is to ensure your mortgage payments are manageable within your budget. Consider how much of your income goes towards it. Are you comfortable with that percentage, or would you prefer to accelerate payments?

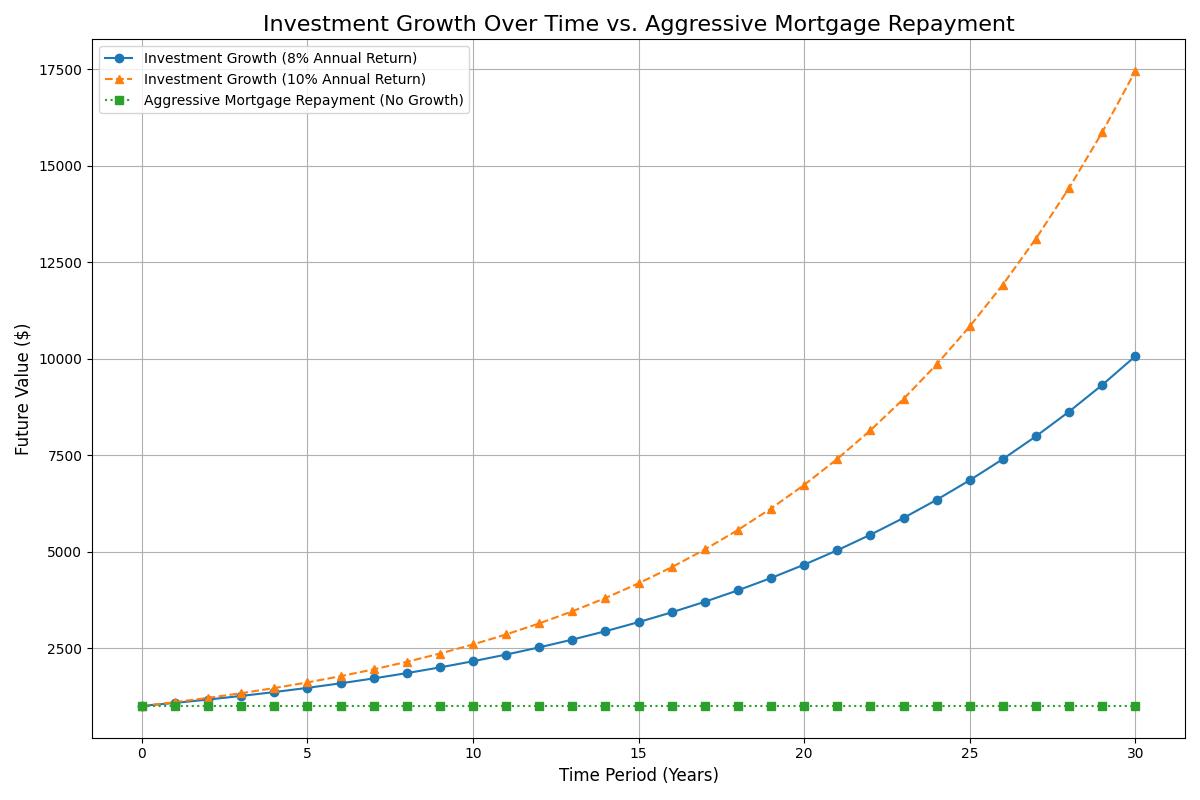

For some, aggressively paying down the mortgage is a priority, offering peace of mind. For others, especially with low interest rates, investing that money elsewhere might yield better returns over the long term. This is where personal strategy comes into play.

Investments: Growing Your Wealth

With a solid income, investing is crucial for wealth creation. The question isn’t just if you should invest, but how and where. Diversification is your best friend here. Spreading your investments across different asset classes – stocks, bonds, perhaps even alternative assets if that aligns with your risk tolerance – can help mitigate risk.

Emerging markets and digital assets, like cryptocurrencies, offer potential growth but also come with higher volatility. My approach has always been to research thoroughly, understand the underlying technology or market dynamics, and only allocate capital I’m comfortable potentially losing. It’s about informed decisions, not just chasing trends.

Planning for Future Goals

When you have a future house purchase in mind, that adds another layer. You need to save for a down payment, closing costs, and potentially moving expenses. This means balancing your current investment strategy with a dedicated savings plan for this specific goal. It might mean temporarily shifting some funds from high-risk investments to more stable savings vehicles as you get closer to your purchase date.

Risk Management: The Unseen Pillar

Beyond the numbers, risk management is vital. What if you lose your job? What if there’s a major market downturn? Having an emergency fund is non-negotiable. This fund should cover 3-6 months of essential living expenses. It’s your safety net, preventing you from having to sell investments at a loss or take on high-interest debt during tough times.

Also, consider insurance. Adequate health, life, and disability insurance protect you and your loved ones from unforeseen events that could derail your financial plans.

The Balancing Act

Ultimately, financial planning is an ongoing balancing act. It’s about aligning your income, savings, investments, and goals. There’s no one-size-fits-all answer. What works for one person might not work for another. The key is to stay informed, regularly review your plan, and adjust as your life circumstances and market conditions change. It’s a marathon, not a sprint, and staying disciplined and informed will get you to your financial finish line.